What to Know Before Investing in Vacant Land

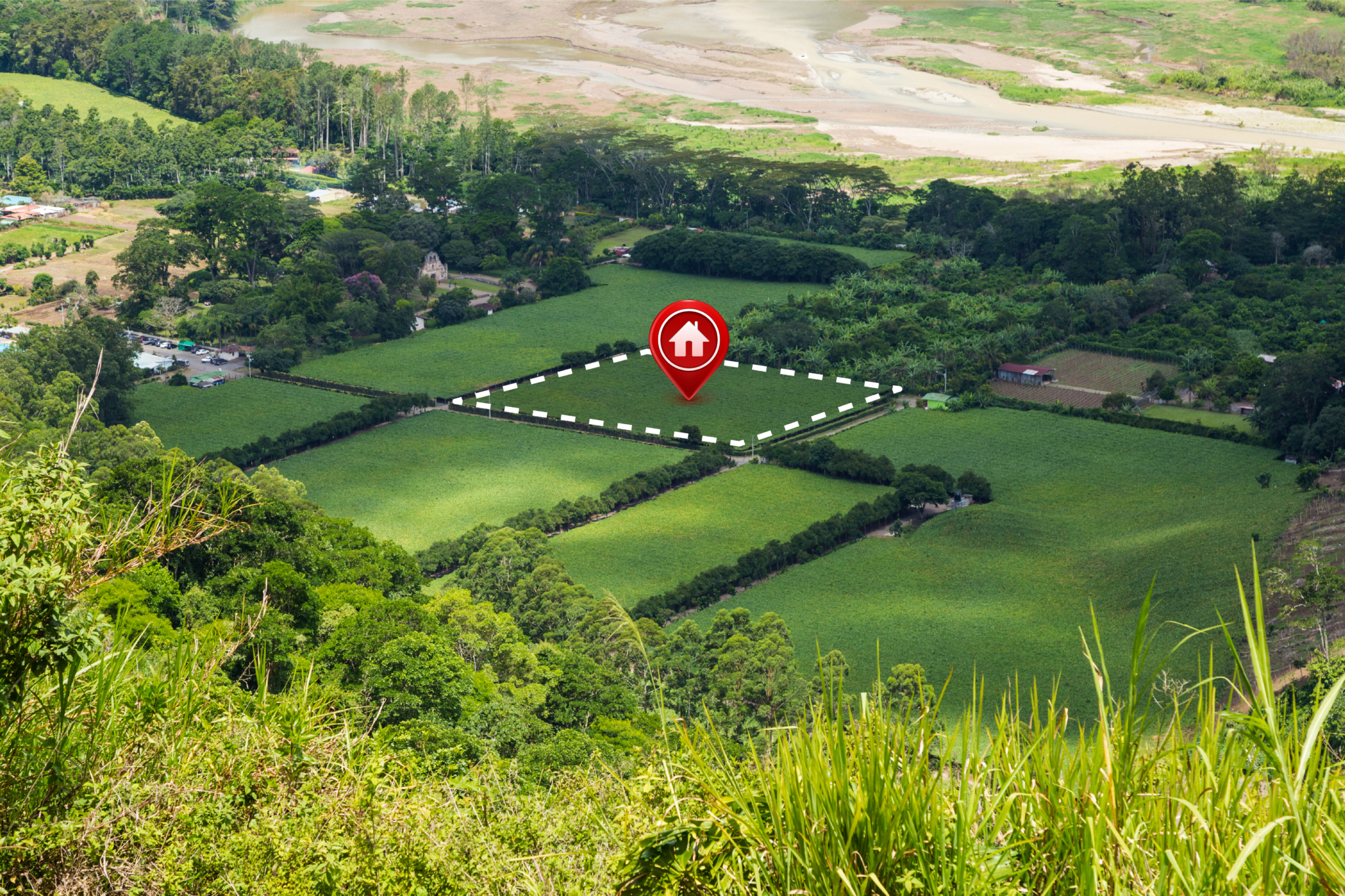

When you explore the idea of buying vacant land, it’s important to remember: often it’s the land — not a house — that holds the greatest value. Because land is finite and in demand, even in a large country, owning a plot of undeveloped land can offer opportunities that extend far beyond just a future home site.

Whether you are eyeing remote acreage or something closer to urban development, the process and considerations differ significantly from buying an established home.

Types of Land: Raw vs Vacant

Understanding the distinction is essential:

- Raw land refers to property that has never been developed — no utilities, no infrastructure, sometimes no road access.

- Vacant land, on the other hand, may have had previous development (or had a structure that was removed) — though it lacks current buildings, there might still be access to services or infrastructure near the property line.

Knowing what kind of land you’re dealing with helps frame expectations, budget, and plan accordingly.

What to Consider: Due Diligence & Pre-Purchase Checklist

Before you commit, there are several critical checks and evaluations to perform:

- Budget & Financing: Secure a realistic budget that includes not just the purchase price but site prep, infrastructure, and contingencies. Financing options for land — such as land mortgages, construction mortgages (if you plan to build), or agricultural loans — often come with stricter requirements and higher down-payments compared to regular home mortgages.

- Location, access & services: Look for legal road access (public-maintained road or registered right-of-way), and proximity to utilities like water, electricity, sewage or septic/well potential, internet connectivity, and other infrastructure. Remote land can be trickier — power lines and water/septic connections may become major expenses.

- Zoning & permitted uses: Check local zoning by-laws, minimum lot sizes, permissible uses (residential, agricultural, commercial), and any restrictions — setbacks, building height limits, or regulations on secondary structures (like guest houses or RVs). Don’t rely solely on listing descriptions — official documents and zoning maps are key.

- Survey, boundaries & legal protections: A current professional survey is critical — it defines boundaries, reveals encroachments or easements, and ensures you’re buying what you think you’re buying. If existing surveys are outdated, commission a new one under your name.

- Site & environmental assessments: Especially on raw or rural land, you’ll want soil testing, topographical studies, and checks for floodplains, wetlands, bedrock issues, or other environmental risks. These factors can affect not only buildability but insurance, regulations, and long-term value.

- Total project cost, timeline & contingencies: Don’t judge land solely by its price per acre — factor in clearing, grading, building access roads or driveways, water and sewage, utilities, permits, design work, site prep, and potential delays (e.g., environmental approvals, municipal reviews, seasonal issues). Having a buffer for unexpected costs or delays is crucial.

Potential Uses & Investment Value

Vacant land isn’t just a blank plot — it can be a flexible long-term investment or the foundation for various projects.

Depending on your vision and neighbourhood context, possibilities include: building a custom home; creating a seasonal or permanent retreat; developing farmland; or holding land as an investment for future appreciation or development.

If the land is well-located and properly serviced, it can also offer rental or leasing opportunities (e.g. storage, parking, small-scale commercial use), or simply act as a long-term passive asset as land values rise.

Risks and Challenges to Watch For

That said — vacant land is not always a guaranteed win. Some of the common pitfalls:

- Remote location may mean limited infrastructure — access to roads, utilities, water, sewage may be expensive or complicated.

- Zoning restrictions, development controls or environmental protections may limit what you can build (or whether you can build at all).

- Soil, terrain, or environmental issues (e.g. wetlands, flood risk, unstable ground) can raise the cost of development or make building unfeasible.

- Financing terms tend to be stricter, with larger down payments and higher interest rates or shorter amortization compared to standard home mortgages.

- Hidden fees: legal costs, survey costs, legal access verification, environmental assessments, permits, and development charges — they add up, so budget carefully.

Because of these uncertainties, the cheapest plot isn’t always the best — weighing total investment (land + development + contingency) is more meaningful than just headline price per acre.

When you explore the idea of buying vacant land, it’s important to remember: often it’s the land — not a house — that holds the greatest value. Because land is finite and in demand, even in a large country, owning a plot of undeveloped land can offer opportunities that extend far beyond just a future home site.

Whether you are eyeing remote acreage or something closer to urban development, the process and considerations differ significantly from buying an established home.

Types of Land: Raw vs Vacant

Understanding the distinction is essential:

- Raw land refers to property that has never been developed — no utilities, no infrastructure, sometimes no road access.

- Vacant land, on the other hand, may have had previous development (or had a structure that was removed) — though it lacks current buildings, there might still be access to services or infrastructure near the property line.

Knowing what kind of land you’re dealing with helps frame expectations, budget, and plan accordingly.

What to Consider: Due Diligence & Pre-Purchase Checklist

Before you commit, there are several critical checks and evaluations to perform:

- Budget & Financing: Secure a realistic budget that includes not just the purchase price but site prep, infrastructure, and contingencies. Financing options for land — such as land mortgages, construction mortgages (if you plan to build), or agricultural loans — often come with stricter requirements and higher down-payments compared to regular home mortgages.

- Location, access & services: Look for legal road access (public-maintained road or registered right-of-way), and proximity to utilities like water, electricity, sewage or septic/well potential, internet connectivity, and other infrastructure. Remote land can be trickier — power lines and water/septic connections may become major expenses.

- Zoning & permitted uses: Check local zoning by-laws, minimum lot sizes, permissible uses (residential, agricultural, commercial), and any restrictions — setbacks, building height limits, or regulations on secondary structures (like guest houses or RVs). Don’t rely solely on listing descriptions — official documents and zoning maps are key.

- Survey, boundaries & legal protections: A current professional survey is critical — it defines boundaries, reveals encroachments or easements, and ensures you’re buying what you think you’re buying. If existing surveys are outdated, commission a new one under your name.

- Site & environmental assessments: Especially on raw or rural land, you’ll want soil testing, topographical studies, and checks for floodplains, wetlands, bedrock issues, or other environmental risks. These factors can affect not only buildability but insurance, regulations, and long-term value.

- Total project cost, timeline & contingencies: Don’t judge land solely by its price per acre — factor in clearing, grading, building access roads or driveways, water and sewage, utilities, permits, design work, site prep, and potential delays (e.g., environmental approvals, municipal reviews, seasonal issues). Having a buffer for unexpected costs or delays is crucial.

Potential Uses & Investment Value

Vacant land isn’t just a blank plot — it can be a flexible long-term investment or the foundation for various projects.

Depending on your vision and neighbourhood context, possibilities include: building a custom home; creating a seasonal or permanent retreat; developing farmland; or holding land as an investment for future appreciation or development.

If the land is well-located and properly serviced, it can also offer rental or leasing opportunities (e.g. storage, parking, small-scale commercial use), or simply act as a long-term passive asset as land values rise.

Risks and Challenges to Watch For

That said — vacant land is not always a guaranteed win. Some of the common pitfalls:

- Remote location may mean limited infrastructure — access to roads, utilities, water, sewage may be expensive or complicated.

- Zoning restrictions, development controls or environmental protections may limit what you can build (or whether you can build at all).

- Soil, terrain, or environmental issues (e.g. wetlands, flood risk, unstable ground) can raise the cost of development or make building unfeasible.

- Financing terms tend to be stricter, with larger down payments and higher interest rates or shorter amortization compared to standard home mortgages.

- Hidden fees: legal costs, survey costs, legal access verification, environmental assessments, permits, and development charges — they add up, so budget carefully.

Because of these uncertainties, the cheapest plot isn’t always the best — weighing total investment (land + development + contingency) is more meaningful than just headline price per acre.